What things can I negotiate when shopping for a car or auto loan?

- English

- Español

When getting an auto loan, negotiating certain terms and features, including interest rates and add-ons, can save you hundreds or even thousands of dollars.

In addition to the price of the vehicle, there are the terms and costs of the auto loan that you may be able to negotiate or control. Together, these amounts can impact your monthly payments and lower your total costs, which could allow you to save a significant amount over the life of the loan.

What auto loan features and add-ons you can negotiate

Annual Percentage Rate (APR) and interest rate

Getting a lower interest rate and APR means you will pay less to borrow money and the amount you’ll pay over the life of your loan will be lower. Lenders base your interest rate and APR on a number of different factors, but to get the lowest APR and interest rate, compare quotes from multiple lenders before you go into the dealership.

For example, getting preapproved by a bank or credit union allows you to show other lenders or your potential dealership the rates you’ve been offered, with the goal of getting competitive offers.

Length of the loan

A shorter loan term, where you make a fewer number of monthly payments, will reduce your loan cost overall. While a longer loan can reduce your monthly payment, you’ll end up paying more interest over the life of your loan.

A longer loan also puts you at risk of having negative equity for a longer period of time, meaning you owe more than the vehicle is worth. For example, if you try to sell or trade-in your car before it’s paid off, you’d still owe money on your loan. The risk of negative equity also depends, in part, on the resale value of used vehicles, which can fluctuate.

Prepayment penalty

If you have a prepayment penalty in your loan terms, you’ll be charged a fee or penalty if you were to pay off the loan early. Ask your lender or dealer if your loan has a prepayment penalty, and if so, you can negotiate to have it removed.

Optional add-on products

Add-on products and services are optional. You’re not required to purchase them, but if you choose to, the price is negotiable.

This may include physical features – such as alarm systems, window tinting, and tire or wheel protection – but it can also include:

- Extended warranties or service contracts

- GAP insurance

- Credit insurance or debt cancellation or suspension products

Keep in mind that if you agree to include add-on features or credit products in your auto loan, it’ll increase both your monthly payments and the total amount you’ll need to borrow and pay back.

Vehicle trade-in value

If you’re looking at trading in your current vehicle, a good first step is to get an approximate value for your trade-in by using online resources, including Consumer Reports, Edmunds, Kelley Blue Book and NADA Guides. Again, the market for used vehicle, which can fluctuate, can also impact your trade-in value. Compare the value you’d get at different dealers vs. selling it to another person directly and putting that money towards a down payment on a new car.

If you have an outstanding balance on your vehicle, understand how much more you’ll need to pay in order for your old loan be paid off. A dealer may offer to “roll in” the balance of your old loan, but beware that this adds costs to your new loan. Learn what you need to do if you owe more on an auto loan than what your car is worth.

Additional fees associated with purchasing a vehicle or your loan

This may include fees charged by the dealer, such as preparation fees, origination fees, document fees, delivery charges, and market adjustments or fees that increase the price over MSRP.

What you can’t negotiate

You can’t negotiate taxes, title, or registration fees set by your local and state government.

Other factors that affect the amount you’ll borrow

- Down payment – The larger the down payment, the less you need to pay back. In fact, increasing your down payment may also decrease your interest rate.

- Manufacturer incentives – Manufacturers offer special deals to advertise certain vehicle models, such as cash rebates or special financing offers, but make sure to read the fine print because these offers may not be available to everyone.

- Car insurance – While auto insurance is separate of your loan, it’s something that should factor into what you’re paying each month for your car. All lenders require that you have insurance, and if you don’t, they may take out “force-placed” insurance, which is more expensive than what you can get on your own.

How to look at your total loan costs vs. monthly payments

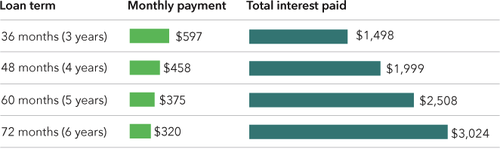

Many people think about a loan in terms of their monthly payment. Instead, the total cost of the loan matters. For example, if you reduce your monthly payment by taking out a longer loan, you will pay more in interest over the life of your loan.

Sample loan amount: $20,000. Interest rate: 4.75%.

The numbers have been rounded to the nearest dollar.

When thinking about your overall financial costs and monthly expenses, it’s also important to keep in mind the monthly cost of insurance as well as the routine and unexpected.

How to keep track of multiple factors when negotiating

Because there are several factors to keep track of as you’re negotiating the best auto loan for your new car or vehicle, you want to make sure you’re writing down or capturing the key details in order to better compare and negotiate.

You may also want to negotiate some of the details separately in order to get the best price. For example, while a dealer may quote you the value of your trade in, you may get a better interest rate and loan terms through a bank or credit union.

When talking with any dealer or lender, ask them to provide:

- Trade-in value of your current vehicle (if applicable)

- Interest rate

- Term of the loan

- Estimated monthly payment

It’s important to get these numbers early in the process. The first quote you receive – whether from a dealership or a bank or credit union – may not be the lowest rate you qualify for. When negotiating, you can also ask for a better rate or more favorable terms.